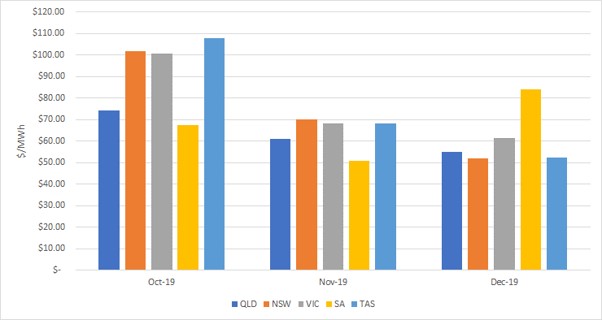

Electricity spot prices in Q419 (October to December) were softer than the prior two Q4’s in Calendar Year 2017 and 2018. Q419 prices continued to be relatively mild following on from Q319’s performance. We did start to see a little more volatility creep into the spot prices towards the end of the year mainly due the bushfire disaster around the NEM and also with heatwave conditions starting to form.

Figure 1: Historical prices for Spring/Summer

(Source: AEMO)

Throughout October and November 2019, we saw milder temperatures and above average wind generation in both VIC and SA with the Bureau of Meteorology (BoM) indicating that a longer than expected Negative SAM (Southern Annular Mode) event was resulting in cooler than expected temperatures and stronger and more frequent westerly winds which was only helping drive solid wind generation levels in the southern NEM regions. As a result, both VIC and SA experienced multiple negatively priced half hours during the daylight hours, with interconnector constraints really dragging down SA’s spot price causing an oversupply in the region; however, cooler temperatures in VIC drove peakier morning and evening peak prices, keeping its spot price for October at least relatively elevated.

SA did however receive a taste of Summer peak pricing and demand, with extreme temperatures leading to a max of 44.8 degrees in Adelaide 19/12. Overnight temperatures on the 19/12 were above 33 degrees in Adelaide at 7pm encouraging the use of air-conditioning and leading to a ramp spike in demand which encouraged a full hour of VoLL (value of loss load) pricing at $14,700/MWh.

Assisting VIC’s peak pricing was the continued downtime of AGL’s Loy Yang A2 unit and Origin’s Mortlake Unit 2 with Mortlake making a return in December 2019, and Loy Yang A2 back for Christmas, offline again shortly after, then offline again for the remainder of the 2019 calendar year. Assisting VIC’s spot price for the quarter was a surge in price in Tasmania for October 2019. With Basslink offline the entire month of September 2019, it would seem both the Basslink operator and Hydro Tas had to play catch-up, keeping the spot price elevated for majority of the October 2019 month, allowing Tas to come away with the highest spot price for October 2019 of all NEM regions.

QLD experienced relatively mild demand and temperatures for the Spring months, and with an already oversupplied market, the introduction of Clean Co and their remit from the QLD government to run down spot prices, and Shell’s take-over of ERM, challenging the market dynamics, resulted in softer than expected spot prices for October and November 2019.

NSW had an interesting run over Q419, sharing in the spoils of the elevated spot prices in VIC and Tas in October 2019 with multiple baseload generators out of action for maintenance, to then dealing with the bushfire crisis in late November through December 2019, resulting in demand losses and cutting generation off from the NEM. Snowy Hydro’s Upper Tumut Pumped Hydro and Tumut 3 Hydro units dispatched frequently throughout the quarter, particularly in December 2019 also choosing to spill at relatively weak spot prices around the $70/MWh mark. I do wonder if we will continue to see Snowy spill at such weak spot prices with water levels at lake Eucumbene starting to plateau at ~30% after a steady incline throughout the last Quarter.

Obviously, impacting all regions in December 2019 was the holiday season shutdown of workplaces and schools, driving lower demand throughout the month.

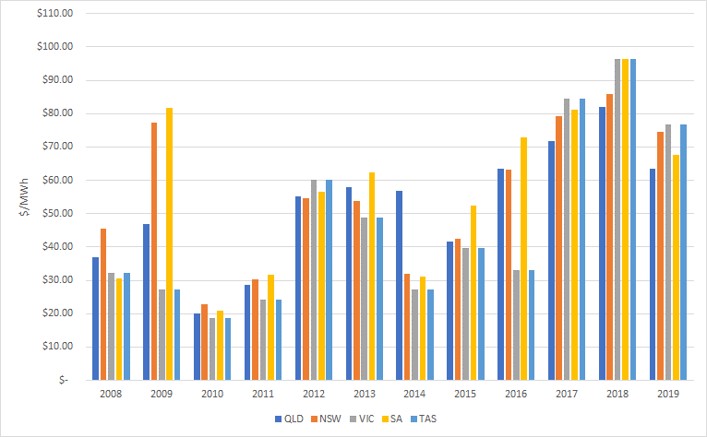

Figure 2: Average monthly spot prices in the NEM

(Source: AEMO)

Friday the 22nd of November saw The Council of Australian Government’s Energy Council meet in Perth to discuss the current and future state of Australia’s Energy network. The key focus for COAG’s energy council was energy security and reliability focussing on Summer 2020 in the near-term and potential changes required for future state surrounding those two variables and of course how to make energy more affordable. Additionally to this, the COAG Energy Council also threw its support behind a National Hydrogen Strategy as laid out by Australia’s chief scientist, Dr. Alan Finkel. AEMO presented to the council outlining how they have prepared for Summer 2020, however COAG’s Energy Council has put forward a call for the Energy Security Board to reassess and to re-jig the current reliability standard (a measure used to ensure enough spare capacity is in the grid to cope with extreme demand days).

Fed Energy Minister Angus Taylor was seeking tougher reliability standards with the rapid influx of renewable generation that now makes up a significant chunk of Australian energy supply, whilst Victorian Energy Minister Lily D’Ambrosio wants tougher standards to deal with the ailing coal-fired generators in her region; either way both were seeking the same result.

There is however the push for higher reliability standards will lead to further ‘gold-plating’ of the network and inevitably higher energy prices for consumers. Probably one of the more surprising outcomes of the COAG Energy Council meeting was the vast support for a National Hydrogen Strategy as put forward by Dr. Alan Finkel and supported by Angus Taylor on the 22nd of November. $370 million dollars will be committed by the Clean Energy Finance Corp (CEFC) and the Australian Renewable Energy Agency (ARENA) to kick start and bankroll “electrolyser” projects, which can convert electricity to hydrogen and allow energy to be stored and transported. Mr Taylor’s support for a national hydrogen industry was met with some backlash however with the Energy Minister stating investment in the technology should be fuel neutral, ie. produced via any means including utilising coal-fired generation to produce the fuel rather than purely utilising renewable sources. The call however was also backed by the need for the hydrogen to have a certificate of origination attached to the sale of the commodity.

In December 2019, it was reported that the Australian Energy Market Operator (AEMO) has procured record volumes of energy reserves for what the Bureau of Meteorology (BoM) is forecasting to be another record Summer in terms of temperatures on the East Coast of Australia. The BoM is forecasting a hot and dry Summer 2020 leading to concerns, particularly for VIC and SA that the two regions could see a repeat of the conditions that inspired both regions in the Summer of 2019 to reach the market price cap after several hours at VoLL (Value of Lost Load) ~ $14,500/MWh ceiling on 24th and 25th of January 2019. The concern that we could see a repeat of these conditions has resulted in AEMO securing 1,600 MW of emergency reserves to assist in keeping the grid energised through summer 2020. The large volume of reserves has not come cheap with an estimated cost of $44 million of which is obviously not guaranteed to be required at all. AEMO has stated that almost 1,000 MW of the reserves secured is available in VIC and SA which have been identified as the “trouble zones” come Summer, with the remaining 600 MW located in NSW/QLD for those extreme conditions days.

The above spot price outcomes resulted in a significant decline in furtures pricing with all curves around the NEM regions and across multiple CAL and Quarterly products all falling away with weaker than anticipated expectations for Summer 2019/2020.

Looking Forward:

Figure 3: Calendar year 2020 forward contracts

| $/MWh | NSW | QLD | SA | VIC | TAS |

| 24-Jan-19 | $ 70.32 | $ 56.36 | $ 66.35 | $ 71.79 | $ 84.96

(as at 31/12/2019) |

(Source: ASX)

If you would like to discuss the electricity market outlook and potential impact to your electricity portfolio, please contact our Manager Wholesale Clients and Markets, Alex Driscoll on 07 3905 9220.