Are the government realising what we have known all along – we won’t make it to Paris?

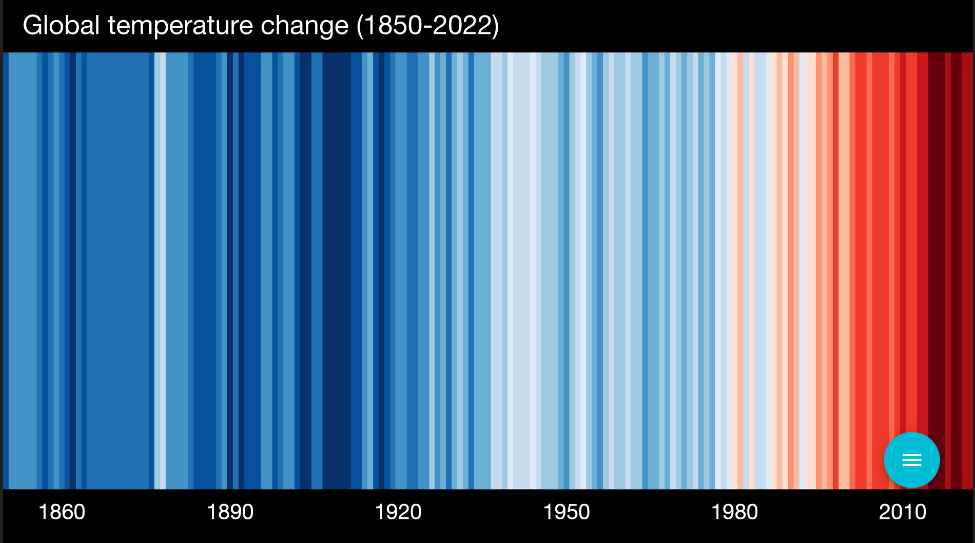

Almost a month after the world’s 6th #ShowYourStripesDay, the day made to spread awareness of climate change using the global Warming stripes https://showyourstripes.info/ the government have continued to apportion blame rather than invest in the industry to help them meet the targets they have set.

This was further evident in the Renew Economy podcast Chris Bowen undertook last week where he stuck to the governments line of “ambitious but possible.” However, leaks out of his office and the concerns that upcoming auctions will not produce the renewable investment results in time for the expect August 2025 closure of Eraring have led to industry starting to move away from the spin and into the reality of the 2025/2026 market, even before the release of the August ESOO.

The well-publicised article in the AFR added further faces and voices to those who are not standing behind the government’s naïve reality. Amongst them Kerry Schott, former chairwoman of the ESB, and Paul Broad the former Snowy Hydro CEO, who have been added to the growing chorus of dissenters who are adamant that Australia will miss its 2030 climate targets. This is in addition to the comments by the AEMO chief Daniel Westermann who cited a lack of investment as the reason Australia will fall short.

However, one question still looms large, if we don’t get there will we need to extend the life of existing coal plants, specifically Eraring whose closure in August 2025 will remove 25% of generation from the NSW grid?

It now looks like we have that answer. The industry at the end of last week was awash with rumours that the long-anticipated announcement around Eraring was starting to gain some certainty. According to an article in the Daily Telegraph on Friday, citing “industry sources,” at least half of the stations generation will indeed stay on post the August 2025 shutdown.

These targets moved further into the horizon when Delta run Vales Point announced they would have the ability to remain on until 2033, four years more than they originally anticipated and securing another 1.3GW on the NSW system into the 2030’s.

Whilst this is good politics, no one is getting re-elected with rolling blackouts on their record, just look at SA. What this does to Australia’s position on the Global stage is a different story. With COP28 coming up in November and December it is likely that we will have a target on our backs before we even mention extension of life.

At Edge2020 our focus is energy savings with an eye on the planet, we are energy brokers, advisory & sustainability consultants. If you would like to ensure your PPA comes from green sources please reach out for support from our Climate Active registered consultants on 1800 334 336 or info@edge2020.com.au.