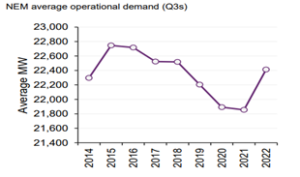

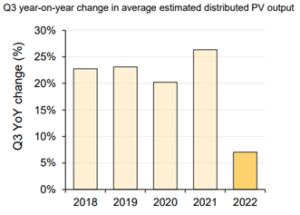

The Clean Energy Council (CEC) recently released to its members their quarterly renewable projects report, which showed only one renewable project, Stubbo solar farm, reached financial close in Q3-2022. The 400MW Stubbo solar farm situated in NSW demonstrates the slowing of the renewable industry. Renewable project growth has slowed by almost 30% compared to Q2 -2022 and over 60% slower than Q3 -2021.

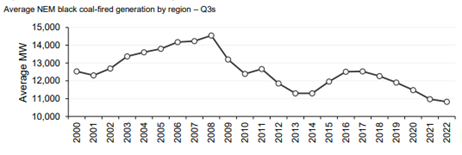

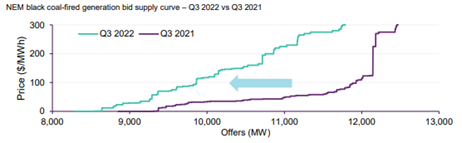

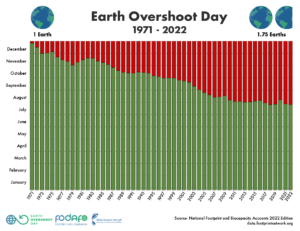

While politicians are talking up the prospects of a renewable energy driven industry to reduce the impact of climate change, the reality reaching the 44GW target outlined by the federal government may be hard to achieve at the current rate of growth. To meet the 44GW target by 2030, a significant number of new wind, solar and storage projects need to come online. If these projects do not happen, the retiring coal generators cannot be replaced and may be forced to remain online.

The CEC says investment in renewable is at an all-time low. Quarterly investment has dropped almost 60% to $418M.

As well as the federal announcements, QLD and VIC have also announced ambitious renewable targets linked to the transition from coal fired generation.

Recently the Federal Minster for Climate Change and Energy estimated Australia must install 22,000 500-watt solar panels every day for eight years, along with 40 seven-megawatt wind turbines every month, backed by at least 10,000 kilometres of additional transmission lines to meet its commitment to reduce emissions by 43 per cent by 2030. This is what is required for us to reach a target of 82% renewables by 2030.

While only one project reached financial close last quarter, three projects started construction during Q3-2022 with an increase of installed capacity of 902MW. As well as another two projects that completed commissioning during Q3-2022.

The Stubbo solar farm project also included a storage device, being the only storage device to reach financial close.

Currently, there are 247 financially committed renewable projects in Australia, with 221 under construction and 169 undergoing commissioning.

The CEC notes that the desire to build new solar, wind, pumped hydro, and transmission lines are meeting opposition from local communities. For example, projects like the Chalumbin wind farm, situated next to World Heritage-listed rainforests in North Queensland are reducing the number of wind turbines they are installing by half due to the concerns from the local community. Another example being part of the Queensland government’s renewable plan which included the construction of the largest pump storage hydro station near Mackay. Mackay locals later found out one of their towns has the potential to be flooded as part of the mega project.

With ambitious renewable targets being spruced by politicians and businesses actively seeking renewable energy to aid in the decarbonisation of their operations, the question of where and when these projects will be delivered needs to be asked. The majority of people support the transition to renewables but obviously not in their backyard.