Edge Energy Services (Edge) provides expert advice to large energy consumers. Good advice starts with understanding the customers energy constraints, requirements and motivations. This means any identifying seasonal or daily trends in demand as well as risk appetite and any green commitments. Once Edge understands the critical information we will facilitate a tailored agreement with an energy provider. For more complex energy portfolio’s, customers may benefit from on-going management services particularly when progressively purchasing or taking spot exposure.

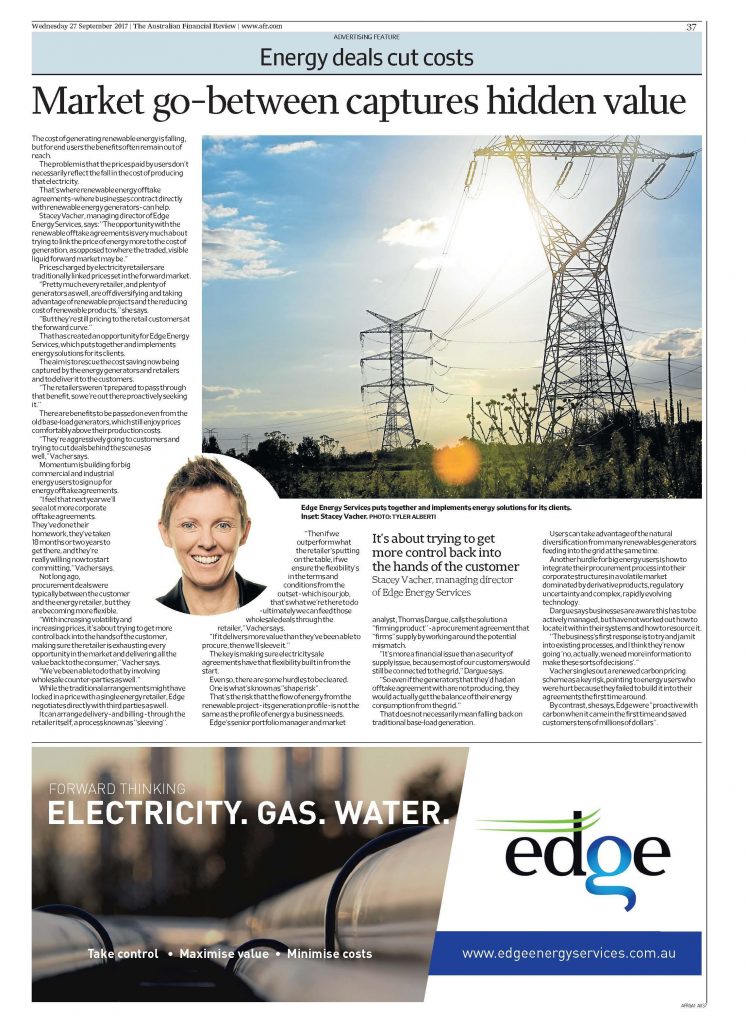

Over the past 18 months wholesale energy prices have increased. This has forced consumers to think more laterally about their energy costs. Most energy providers will base their pricing offers on the forward curve that day. If the customer wants to reduce exposure to the forward curve one option is to enter into an agreement directly with a generator through a Power Purchase Agreement (PPA). These agreements commit the customer to purchasing the offtake from a generator at a set price for a defined term, usually a minimum of 10 years. As technology continues to improve the cost of generating electricity declines and PPA’s become increasingly appealing. You can read more about what Edge is doing in this space in todays Australian Financial Review.

High Resolution PDF – Energy Deals Cut Costs

Edge understands that your business may be at early stages when it comes your energy strategy. If you are in a planning stage and would like to understand your options Edge will be able to provide you the facts. If your organisation has a green energy commitment then Edge can tailor a product to suit your energy demand and corporate commitments. Alternatively you may benefit from onsite generation which can reduce both energy and transmission cost.

Whatever stage your organisation is at, there is potential value to be gained by entering into alternative supply agreements or taking a more sophisticated approach to managing your energy portfolio. Edge can help If you would like to learn more about Edge, please visit edge2020.com.au or alternatively you can call one of our team directly on 07 3232 1115.